With Arizona’s real estate market at a boiling point—high home prices and interest rates soaring—it’s become increasingly difficult to find that “perfect” home. The one that fits your budget, meets your needs, and (at least on the surface) doesn’t seem to have any major dealbreakers. But then, just when you think you’ve found “the one,” you get hit with the reality of an aging tile roof.

Sure, the house checks all the boxes, but the roof is another story. It’s 20 years old and hasn’t seen much rain in recent years. How can you tell if it’s in good shape or just one rainstorm away from a costly leak? Is it worth taking the gamble? Let’s dive into the dilemma.

How Do You Know if an Old Roof Has Leaks?

One of the biggest risks when buying a home with an aging roof is the uncertainty of what might happen the moment the next big rain hits. In Arizona, rain is relatively sparse, and roofs often get a pass when it comes to wear and tear because they don’t face regular storms. A roof might look fine on a dry day, but that doesn’t mean it will hold up during a major downpour.

When it comes to inspecting a roof that’s 20 years old, it’s not easy to know if it has leaks, especially when there’s no visible evidence. In many cases, sellers are not required to disclose past leaks, leaving the buyer to take on the risk of unseen damage. While some sellers might be upfront, it’s not uncommon to hear “no issues” or “no past leaks,” when in reality, there may have been water intrusion that was patched up and never properly addressed.

So, what’s a buyer to do?

The Inspection Report: What Can You Expect?

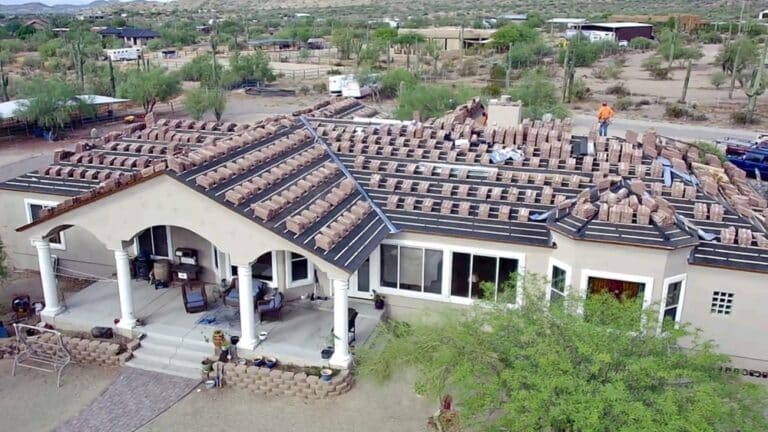

In this case, you hire a trusted roofing company—like Stapleton Roofing—to do a thorough inspection. The report might show things like:

- Rolled Underlayment: This is a sign that the roof’s underlayment (the material beneath the tiles) has started to degrade or shift, which is a common issue for older roofs.

- Shifted or Broken Tiles: Missing or cracked tiles can expose the underlayment to the elements, causing potential leaks down the line. While they may look relatively minor, they can be a sign of a more serious problem lurking beneath.

These issues are all common signs of an aging roof, but they don’t necessarily mean the roof will leak immediately. However, they do mean the roof will need attention soon—and you, as the buyer, will be on the hook for those repairs.

The Dry Desert Climate and Its Effect on Tile Roofs

In Arizona’s dry desert climate, the underlayment of tile roofs faces a unique challenge. While the tiles themselves are incredibly durable, the intense heat and dryness cause the underlayment (the material that sits beneath the tiles and protects the roof) to break down over time. People moving to Arizona from other states that aren’t familiar with tile roofs might not realize that the tile itself doesn’t wear out nearly as quickly as the underlayment.

Though the tiles are designed to last 30 years or more, the underlayment typically lasts around 20 to 25 years before it begins to degrade. As the underlayment dries out and becomes brittle, it no longer provides the same level of waterproofing, and that’s when leaks become more likely. The tiles might still look great, but without a solid underlayment, the roof may not perform as it should.

If the underlayment fails, the tiles might need to be removed to replace the underlayment underneath—but the good news is that most of the time, the existing tiles can be reused. However, there are instances where the original tile may no longer be available, especially if the home’s roof is an older style. In these cases, roofers will do their best to match the existing tiles, but the color and texture might not be a perfect match. This is something to consider when buying a home with an aging tile roof.

Paying Full Price or Negotiating for a New Roof?

Now comes the tough decision: do you pay full price for the house, knowing that you might need a new roof in the near future? Or do you try to negotiate the price, hoping you can buy a couple of years of roof life before the next major rainstorm?

This is where the gamble comes in.

If you buy the house at full price, you’re assuming the risk of dealing with a roof replacement sooner than later. Roofing replacements can cost anywhere from $10,000 to $30,000 or more, depending on the size of the home and type of roofing material used. With interest rates so high, that’s a big financial hit.

On the other hand, if you try to negotiate a lower price based on the condition of the roof, there’s no guarantee that the seller will agree to a price reduction, or that the amount they lower the price will be enough to cover a new roof. Additionally, the seller might not even acknowledge the roof’s aging condition as a reason to drop the price.

So, what do you do?

A Roof Without a Warranty: More of a Gamble

One of the biggest wild cards in this situation is that many homes—especially older ones—don’t come with a roof warranty in place. A roof warranty can provide you with peace of mind if the roof has been recently replaced or if the seller has had regular maintenance done. Without one, you’re rolling the dice on the roof’s longevity and the costs involved if something goes wrong.

Without a warranty, you’re left to trust that the roof will hold up for a few more years—possibly longer—before it needs replacing. But when you don’t know the full history of the roof’s condition, the risk is heightened.

Is It Worth It? Here Are a Few Things to Consider:

- How Long Can You Afford to Wait?: If you’re already stretched thin with a higher-than-expected mortgage payment due to high interest rates, replacing a roof in the near future might not be in your budget.

- The Age of the Roof: A 20-year-old tile roof is nearing the end of its lifespan (tile roofs typically last 25-30 years). If the roof has been well-maintained, it might still have a few more years left. However, it’s important to factor in the potential costs if it doesn’t.

- The Cost of Repairs: While replacing the entire roof can be a huge expense, there may be less costly repairs you can do to extend its life. For instance, addressing broken tiles or replacing the underlayment could help buy you more time.

- Negotiating for a Discount: Even if the seller won’t give you a full discount, you might be able to negotiate for a credit at closing. This could give you a bit more breathing room financially to take care of the roof once you move in.

Final Thoughts: It’s a Gamble, But One You Can Manage

Buying a home with an old roof is undeniably risky, especially when you’re already dealing with high prices and interest rates. However, it doesn’t have to be a decision you make blindly. Get the roof inspected, consider your options carefully, and weigh the costs of potential repairs or replacements. If you’re willing to take on the risk and can negotiate a reasonable price, the right home might still be within your reach. But, if you’re not prepared for a major roofing overhaul, it might be worth continuing the search for a property that has a little more certainty built into it.

In the end, this is all about balancing the gamble with the potential rewards. Just be sure that if you do take the leap, you have a solid plan in place to manage any unforeseen roof issues that may come your way.